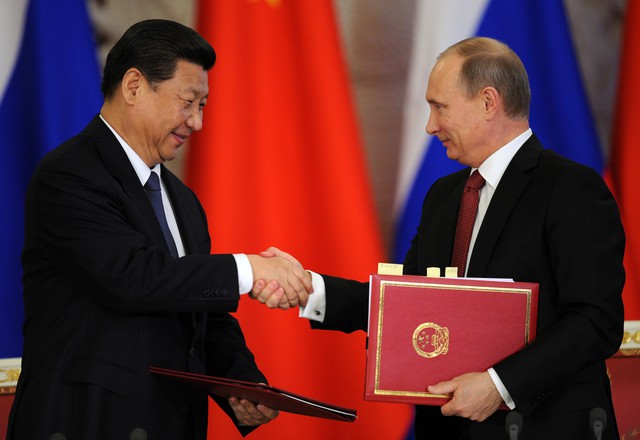

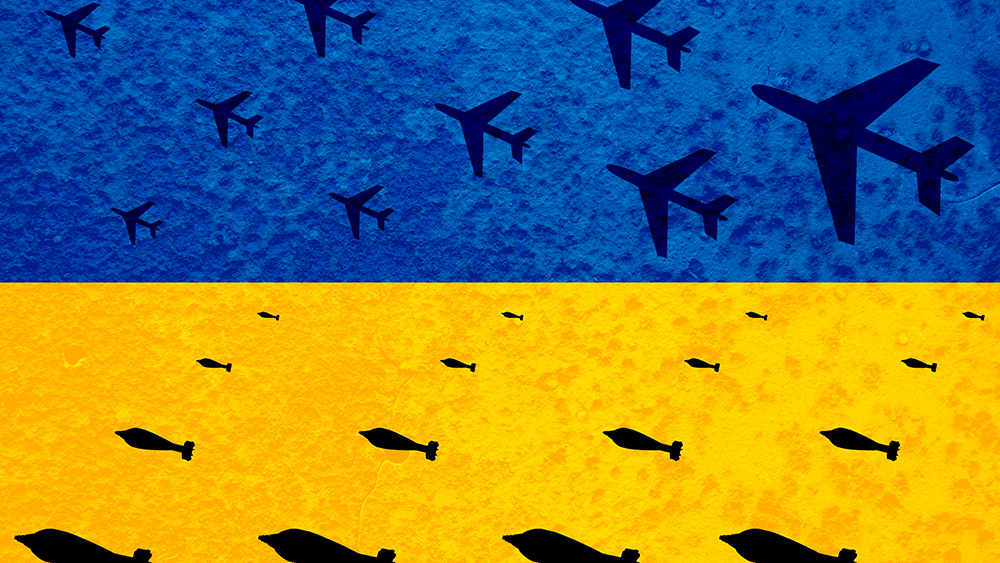

The war in Ukraine marks the end of the American Century – Washington has greatly underestimated its vulnerability to catastrophic geopolitical blowback

10/03/2022 / By News Editors

“The ferocity of the confrontation in Ukraine shows that we’re talking about much more than the fate of the regime in Kiev. The architecture of the entire world order is at stake.” Sergei Naryshkin, Director of Foreign Intelligence

Here’s your ‘reserve currency’ thought for the day: Every US dollar is a check written on an account that is overdrawn by 30 trillion dollars.

(Article by Brandon Campbell republished from BillKloss.Law.blog)

It’s true. The “full faith and credit” of the US Treasury is largely a myth held together by an institutional framework that rests on a foundation of pure sand. In fact, the USD is not worth the paper it is printed on; it is an IOU flailing in an ocean of red ink. The only thing keeping the USD from vanishing into the ether, is the trust of credulous people who continue to accept it as legal tender.

But why do people remain confident in the dollar when its flaws are known to all? After all, America’s $30 trillion National Debt is hardly a secret, nor is the additional $9 trillion that’s piled up on the Fed’s balance sheet. That is a stealth debt of which the American people are completely unaware, but they are responsible for all the same.

In order to answer that question, we need to look at how the system actually works and how the dollar is propped up by the numerous institutions that were created following WW2. These institutions provide an environment for conducting history’s longest and most flagrant swindle, the exchange of high-ticket manufactured goods, raw materials and hard-labor for slips of green paper with dead presidents on them. One can only marvel at the genius of the elites who concocted this scam and then imposed it wholesale on the masses without a peep of protest. Of course, the system is accompanied by various enforcement mechanisms that swiftly remove anyone who tries to either break free from the dollar or, God help us, create an alternate system altogether. (Saddam Hussein and Muammar Qaddafi come to mind.) But the fact is– aside from the institutional framework and the ruthless extermination of dollar opponents – there’s no reason why humanity should remain yoked to a currency that is buried beneath a mountain of debt and whose real value is virtually unknowable.

It wasn’t always like this. There was a time when the dollar was the strongest currency in the world and deserved its spot at the top of the heap. Following WW1, the US was “the owner of the majority of the world’s gold” which was why an international delegation “decided that the world’s currencies would no longer be linked to gold but could be pegged to the U.S. dollar, “because the greenback was, itself, linked to gold.” Here’s more from an article at Investopedia:

“The arrangement came to be known as the Bretton Woods Agreement. It established the authority of central banks, which would maintain fixed exchange rates between their currencies and the dollar. In turn, the United States would redeem U.S. dollars for gold on demand….

The U.S dollar was officially crowned the world’s reserve currency and was backed by the world’s largest gold reserves thanks to the Bretton Woods Agreement. Instead of gold reserves, other countries accumulated reserves of U.S. dollars. Needing a place to store their dollars, countries began buying U.S. Treasury securities, which they considered to be a safe store of money.

The demand for Treasury securities, coupled with the deficit spending needed to finance the Vietnam War and the Great Society domestic programs, caused the United States to flood the market with paper money….

The demand for gold was such that President Richard Nixon was forced to intervene and de-link the dollar from gold, which led to the floating exchange rates that exist today. Although there have been periods of stagflation, which is defined as high inflation and high unemployment, the U.S. dollar has remained the world’s reserve currency.”

But now the gold is gone and what’s left is a steaming pile of debt. So, how on earth has the dollar managed to preserve its status as the world’s preeminent currency?

Proponents of the dollar system, will tell you it has something to do with “the size and strength of the U.S. economy and the dominance of the U.S. financial markets.” But that’s nonsense.

The truth is, reserve currency status has nothing to do with “the size and strength” of America’s post-industrial, service-oriented, bubble-driven, third-world-sh**hole economy. Nor does it have anything to do with the alleged safety of US Treasuries” which– next to the dollar– is the biggest Ponzi flim-flam of all time.

The real reason the dollar has remained the world’s premier currency is because of the cartelization of Central Banking. The Western Central Banks are a de facto monopoly run by a small cabal of inter-breeding bottom-feeders who coordinate and collude on monetary policy in order to preserve their maniacal death-grip on the financial markets and the global economy. It’s a Monetary Mafia and– as George Carlin famously said: “You and I are not in it. You and I are not in the big club.” Bottom line: It is the relentless manipulation of interest rates, forward guidance and Quantitative Easing (QE) that has kept the dollar in its lofty but undeserved spot.

But all that is about to change due entirely to Biden’s reckless foreign policy which is forcing critical players in the global economy to create their own rival system. This is a real tragedy for the West that has enjoyed a century of nonstop wealth extraction from the developing world. Now– due to the economic sanctions on Russia– an entirely new order is emerging in which the dollar will be substituted for national currencies (processed through an independent financial settlement system) in bilateral trade deals until– later this year– Russia launches an exchange-traded commodities-backed currency that will be used by trading partners in Asia and Africa. Washington’s theft of Russia’s foreign reserves in April turbo-charged the current process which was further accelerated by banning of Russia from foreign markets. In short, US economic sanctions and boycotts have expanded the non-dollar zone by many orders of magnitude and forced the creation of a new monetary order.

How dumb is that? For decades the US has been running a scam in which it exchanges its fishwrap currency for things of genuine value. (oil, manufactured goods and labor) But now the Biden troupe has scrapped that system altogether and divided the world into warring camps.

But, why?

To punish Russia, is that it?

Yes, that’s it.

But, if that’s the case, then shouldn’t we try to figure out whether the sanctions actually work or not before we recklessly change the system?

Too late for that. The war on Russia has begun and the early results are already pouring in. Just look at the way we’ve destroyed Russia’s currency, the ruble. It’s shocking! Here’s the scoop from an article at CBS:

“The Russian ruble is the best-performing currency in the world this year….

Two months after the ruble’s value fell to less than a U.S. penny amid the swiftest, toughest economic sanctions in modern history, Russia’s currency has mounted a stunning turnaround. The ruble has jumped 40% against the dollar since January.

Normally, a country facing international sanctions and a major military conflict would see investors fleeing and a steady outflow of capital, causing its currency to drop….

The ruble’s resiliency means that Russia is partly insulated from the punishing economic penalties imposed by Western nations after its invasion of Ukraine…”

Huh? You mean the attack on the ruble didn’t work after all?

Sure looks that way. But that doesn’t mean the sanctions are a failure. Oh, no. Just at look at the effect they’ve had on Russian commodities. Export receipts are way-down, right? Here’s more from CBS:

“Commodity prices are currently sky-high, and even though there is a drop in the volume of Russian exports due to embargoes and sanctioning, the increase in commodity prices more than compensates for these drops,” said Tatiana Orlova, lead emerging markets economist at Oxford Economics.

Russia is pulling in nearly $20 billion a month from energy exports. Since the end of March, many foreign buyers have complied with a demand to pay for energy in rubles, pushing up the currency’s value.”

You’re kidding me? You mean the ruble is surging and Putin is raking in more dough on commodities than ever before?

Yep, and it’s the same deal with Russia’s trade surplus. Take a look at this excerpt from an article in The Economist:

“Russia’s exports… have held up surprisingly well, including those directed to the West. Sanctions permit the sale of oil and gas to most of the world to continue uninterrupted. And a spike in energy prices has boosted revenues further.

As a result, analysts expect Russia’s trade surplus to hit record highs in the coming months. The IIF reckons that in 2022 the current-account surplus, which includes trade and some financial flows, could come in at $250bn (15% of last year’s GDP), more than double the $120bn recorded in 2021. That sanctions have boosted Russia’s trade surplus, and thus helped finance the war, is disappointing, says Mr Vistesen. Ms Ribakova reckons that the efficacy of financial sanctions may have reached its limits. A decision to tighten trade sanctions must come next.

But such measures could take time to take effect. Even if the EU enacts its proposal to ban Russian oil, the embargo would be phased in so slowly that the bloc’s oil imports from Russia would fall by just 19% this year, says Liam Peach of Capital Economics, a consultancy. The full impact of these sanctions would be felt only at the start of 2023—by which point Mr Putin will have amassed billions to fund his war.”

Let me get this straight: The sanctions are actually hurting the US and helping Russia, so the experts think we should impose more sanctions? Is that it?

Precisely. Now that we have shot ourselves in the foot, the experts think it would be wise to shoot the other one too.

Read more at: BillKloss.Law.blog

Submit a correction >>

Tagged Under:

American Century, big government, collusion, conspiracy, corruption, currency crash, currency reset, deception, deep state, dollar demise, economic collapse, finance, globalism, government debt, Joe Biden, market crash, national debt, national security, pensions, reserve currency, risk, Russia, sanctions, Ukraine, Us Dollar, war, Washington, WWIII

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

SupplyChainWarning.com is a fact-based public education website published by SupplyChainWarning.com Features, LLC.

All content copyright © 2021 by SupplyChainWarning.com Features, LLC.

Contact Us with Tips or Corrections

All trademarks, registered trademarks and servicemarks mentioned on this site are the property of their respective owners.